Contents:

For example, your company might send a customer an invoice for $10,000 to be paid within 30 days. However, you could offer a sales discount of 1% off if they pay within 10 days (this particular offer would be known as a 1/10 net 30 in discount terms). Sales discounts apply to any early payment discounts which are offered to customers when they pay an invoice within a specified period. Datarails’ FP&A software can help your company implement automation that can help your FP&A team operate more efficiently and effectively. Datarails is helping FP&A teams all over the globe reduce the time they spend on traditional reporting and planning.

You may also hear it referred to as the earnings before interest or taxes . For example, SaaS companies typically operate with high gross profit margins, ranging from 60% to 70%, according to NYU Stern School of Business. Both gross profit and net profit provide valuable insight into your business’s financial health. For companies that sell physical goods, COGS will also include raw material costs, labor costs, production costs, and other expenses to deduct from your company’s revenue. To find the gross margin, you simply deduct the cost of goods sold from the net revenue or net sales. These costs include the sales overhead costs, the labor costs, manufacturing costs, and so on.

A positive net profit will send the right signals to investors and increase your chances of attracting one. Net profits, on the other hand, can be useful in providing a clearer view of your company’s health and potential cash flow. And, unlike your company’s gross profit, your company’s net profit can be used to attract investors. Manually preparing expense reports, income statements, and cash flow statements can be time-consuming.

What can you learn from Net Sales?

The gross sales amount is not used for decision-making, whereas the net sales amount is used for decision-making. The gross sales amount is always equal to or higher than as compared to the net sales amount. Business expenses are costs incurred in the ordinary course of business. Business expenses are tax-deductible and are always netted against business income. David Kindness is a Certified Public Accountant and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes.

As a startup owner, you likely feel your brain is at capacity when it comes to https://1investing.in/s and financial knowledge. But understanding gross profits and net profits can help you make informed decisions about your business. These decisions can open the door to more opportunities — like attracting investors — and help you take your business to new places. In short, gross profit is your revenue without subtracting your manufacturing or production expenses, while net profit is your gross profit minus the cost of all business operations and non-operations. Your net profit is going to be a much more realistic representation of your company’s profits.

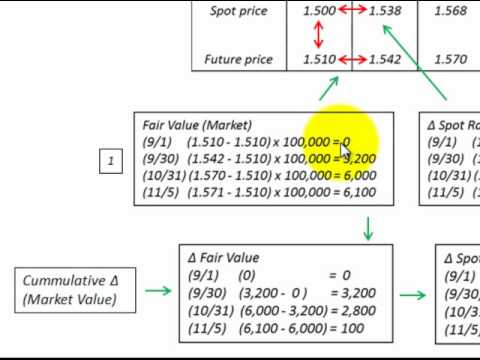

How gross revenue and net revenue impact financing

Get deep insights into your company’s MRR, churn and other vital metrics for your SaaS business. Next, you decide to offer a price-matching deal vs. your main competitor to reduce churn and 10 customers come with your competitor’s ad with a price of $40, so you refund each of them $10. This means that you’ll subtract $1,000 (20 × $50) from the gross revenue for a net revenue of $49,000. For example, if your company has 1000 subscriptions at $50/month each, then your gross revenue for that month will be $50,000 ($50 × 1000).

Business accounting can seem challenging, particularly if you are trying to get your books to apply for business financing. These are just some examples of how sales forecasts impact a company. However, the difference between Gross and Net figures in Accounting can tell you a lot about your business.

Canadian retailer Reitmans records 20.9% rise in net sales in FY23 – Retail Insight Network

Canadian retailer Reitmans records 20.9% rise in net sales in FY23.

Posted: Fri, 14 Apr 2023 10:06:00 GMT [source]

Investors will see that as a net positive, as will others who examine your accounts. The calculation of net sales gives you a better idea of how much money you’re actually making from your sales. It can also point up issues you may be having, such as a very high return rate, that affects how much money you end up making. Cost of Sales represents a measurement of the cost efficiency of your business. By calculating it regularly, you can identify inefficiencies in your operations and opportunities to reduce costs and improve operating margins. Net sales and cost of goods are prime indicators of profitability and efficiency of the company.

Cost of Sales vs. Cost of Goods Sold (COGS)

A sales return is usually accounted for either as an increase to a sales returns and allowances contra-account to sales revenue or as a direct decrease in sales revenue. As such, it debits a sales returns and allowances account and credits an asset account, typically cash or accounts receivable. This transaction carries over to the income statement as a reduction in revenue.

Your mark to market, as they say, can create a ripple effect on your entire business’s financial health, from budget allocation, hiring your team, and even forming relationships with clients and investors. Gross Sales is the total value of all your orders or invoices for a predefined period, so taxes are included. Taxes are one of the things that are deducted from Gross Sales to calculate Net Sales.

Under the reporting policies established under accrual accounting, revenue must be recognized in the period it was earned, whether or not cash was received. In contrast, revenue is not recognized under cash basis accounting until the company has received the actual cash payments from the customer. Say the operations at the Battery Operated Light Up Hooting Owl Pest Deterrent factory ground to a halt, and the company wound up shipping one of its products to a buyer a month late. By that point, the customer had grown frustrated with the number of pests in their backyard and turned to a company that sold battery-operated, laser-eyed, screeching hawk pest deterrents.

Moreover, customer reviews and feedback can provide valuable insight into what you are doing wrong. Taking the previous example, the net sales of the company is $970,000. Now, if the total amount spent on employee wages and operating taxes is $350,000, then the net income of the company is $620,000.

Net revenue, however, refers to the total amount of money that the company collected after adjusting for returns and allowances. Gross revenue is the total amount of money generated by the sale of goods or services over a period of time, such as a quarter or a year. It’s often used to indicate your business’s ability to sell its products and make income, but it doesn’t consider expenses. Gross sales of the company are calculated without considering the returns, discounts, and the company’s allowances related to those sales. On the other hand, the net sale of the company is calculated after taking into consideration all these.

What Is the Difference Between Gross Sales and Total Sales?

Days payable outstanding is a ratio used to figure out how long it takes a company, on average, to pay its bills and invoices. By submitting my personal data, I consent to Zendesk collecting, processing, and storing my information in accordance with the Zendesk Privacy Notice. Please select this checkbox if you do not wish to receive marketing communications from Zendesk.

- With your gross profit in hand, you can get an accurate view of your total sales and how they’re impacted by the cost of things like raw materials, manual labor, and facility taxes.

- According to research, 34% of startups fail due to a lack of product-market fit, making it the most common reason new ventures close shop.

- In some cases, your Gross Sales and Net Sales figures could be the same – if you haven’t had to make any allowances, offer any discounts or had any returns for the reporting period.

- Net revenue measures how much money your company brought in after accounting for all expenses in the same period.

Gross refers to the “total” or “whole” while net refers to “what remains”. For example, gross profit, sometimes referred to as gross income, is the profit the company makes from the sales of its goods and services. The net profit is the profit that remains after all the expenses are subtracted from the revenue.

This gives your business a healthy cash flow, but if the discount is too high or if too many customers are using it, it can affect your final sales figure. A business might start by declaring its gross sales , then listing the different sales deductions made as line items . Other companies skip the part of identifying the gross sales and deductions and simply list the net income or net revenue. Gross sales and net sales will feature in your financial statements, specifically as the top line on the company’s income statement .

To avoid getting overwhelmed, use a sales CRM like Zendesk Sell to keep tabs on all the important metrics. Zendesk automates the measurement of sales metrics so you can focus on keeping your top and bottom lines strong. But they’re not the only sales metrics you should analyze and monitor regularly.